When evaluating the cost of living across the United States, it's essential to consider the various factors that impact how far a dollar can stretch in different states. This article ranks all 50 states by cost of living, providing a comprehensive overview to help you make informed decisions, whether you're considering relocation, retirement, or simply curious about economic conditions across the country.

The ranking is based on several key factors, including:

- Housing Costs: The price of buying or renting a home, property taxes, and utility costs.

- Food and Groceries: The average cost of groceries and dining out.

- Transportation: Costs associated with owning and maintaining a vehicle, public transportation fares, and gasoline prices.

- Healthcare: The average cost of healthcare services, including insurance premiums, out-of-pocket expenses, and prescription drug prices.

- Utilities: Monthly costs for electricity, water, heating, and cooling.

- Taxes: State and local tax burdens, including income, sales, and property taxes.

- Miscellaneous Goods and Services: Costs of everyday services and goods, such as clothing, entertainment, and personal care items.

By analyzing these components, this ranking provides a clear picture of where each state stands in terms of affordability and cost-effectiveness, helping you understand the financial landscape across the nation.

Mississippi is one of the most affordable states in the U.S. The cost of housing, groceries, utilities, and transportation is significantly lower than the national average. This affordability can stretch retirement savings further, allowing for a comfortable lifestyle on a fixed income.

The cost of living in Mississippi is notably below the national average, making it a cost-effective choice for retirees. The state's lower property taxes and affordable real estate are major contributing factors.

2 Oklahoma

One of the most attractive aspects of retiring in Oklahoma is its low cost of living. Housing, healthcare, and everyday expenses are significantly lower than the national average. The state does not tax Social Security benefits, and property taxes are relatively low, making it financially advantageous for retirees on a fixed income. Affordable housing options range from modern urban apartments to spacious rural homes, catering to diverse preferences and budgets.

3 Kansas

One of Kansas's most significant advantages for retirees is its affordable cost of living. Housing costs, in particular, are well below the national average, making it easier for retirees to purchase a home or find rental properties within their budget. Utilities, groceries, and transportation costs are also lower than the national average.

In contrast to more expensive states, Kansas allows retirees to stretch their savings further, providing more financial freedom and less stress about day-to-day expenses. This affordability can be particularly beneficial for those on a fixed income.

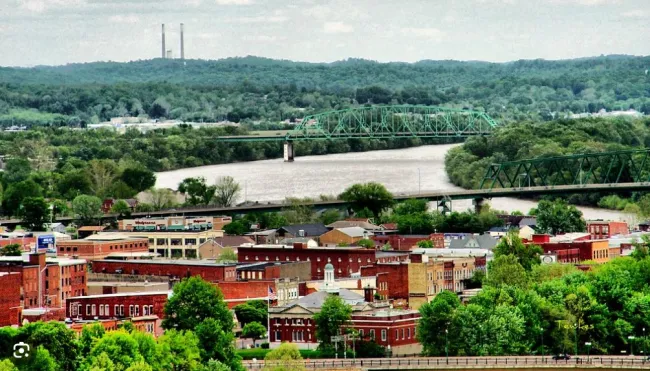

4 Missouri

One of Missouri's most attractive features for retirees is its affordable cost of living. The state's housing costs are significantly lower than the national average, making it possible to find comfortable and affordable homes in various settings, from urban condos to rural farmhouses. Utilities, groceries, and transportation are also generally less expensive than in many other states.

Missouri does not tax Social Security benefits, which can be a significant advantage for retirees. Additionally, the state's property taxes are relatively low, further enhancing its appeal for those on a fixed income.

5 Alabama

Alabama is known for its affordable cost of living. Housing costs are particularly low, with median home prices well below the national average. Property taxes are also among the lowest in the country. This affordability extends to groceries, transportation, and other daily expenses, making it an attractive option for retirees on a fixed income.

The overall cost of living in Alabama is significantly lower than the national average, making it one of the more affordable states for retirees. This lower cost of living allows retirees to stretch their savings further, potentially improving their overall financial security.

6 Iowa

One of the most attractive aspects of retiring in Iowa is its affordable cost of living. Housing, in particular, is significantly cheaper than the national average, with lower property taxes and utility costs. Groceries, healthcare, and transportation also tend to be more affordable, allowing retirees to stretch their retirement savings further.

Overall, Iowa's cost of living index is lower than the national average, making it an economically advantageous place for retirees looking to maintain a comfortable lifestyle without breaking the bank.

7 Nebraska

Nebraska's cost of living is generally lower than the national average, making it an attractive option for retirees on a fixed income. Housing costs, in particular, are significantly lower, with affordable options in both urban and rural areas. The median home price in Nebraska is well below the national median, allowing retirees to stretch their savings further.

Utilities, groceries, and transportation costs are also more affordable than the national average. This lower cost of living means that retirees can enjoy a comfortable lifestyle without the financial strain often experienced in more expensive states.

8 Arkansas

One of Arkansas's most attractive features for retirees is its low cost of living. Housing costs, utilities, and groceries are significantly below the national average. In particular, housing costs in Arkansas are some of the lowest in the country, making it an affordable place to buy or rent a home. Additionally, the state offers various tax benefits for retirees, including exemptions on Social Security income and partial exemptions on other retirement income.

One of the most attractive aspects of retiring in West Virginia is its affordable cost of living. The state consistently ranks below the national average in terms of housing, utilities, groceries, and transportation costs. For retirees on a fixed income, this can be a significant advantage, allowing them to stretch their retirement savings further.

Housing prices in West Virginia are particularly low, with the median home price significantly below the national median. This affordability extends to property taxes and utility costs, making it an economically friendly state for retirees.

10 Tennessee

One of Tennessee's most significant advantages for retirees is its affordability. The cost of living in Tennessee is lower than the national average, making it an attractive option for those on a fixed income. Housing costs, in particular, are significantly lower, with the median home price well below the national median. Additionally, Tennessee has no state income tax, which can be a significant financial benefit for retirees relying on pensions, Social Security, or other income sources.

Everyday expenses such as groceries, transportation, and healthcare also tend to be more affordable compared to many other states, allowing retirees to stretch their retirement savings further.

11 Illinois

Illinois has a relatively high cost of living, particularly in urban areas like Chicago. Housing prices, taxes, and general living expenses can be above the national average. However, certain areas, especially in the southern and central parts of the state, offer more affordable options. The state's flat income tax rate of 4.95% and high property taxes are noteworthy considerations for retirees.

Illinois' cost of living is generally higher than the national average, especially in terms of housing and taxes. However, it is still more affordable than many coastal states, offering a balance between urban amenities and affordability in less populated regions.

12 Georgia

Georgia's cost of living is generally lower than the national average, making it an affordable choice for retirees. Housing costs, in particular, are more reasonable, with options ranging from urban apartments to suburban homes and rural properties. Additionally, groceries, healthcare, and utilities are often more affordable than in other parts of the country.

The state's tax-friendly policies for retirees, including no Social Security tax and exemptions on retirement income, further enhance its appeal. This financial advantage allows retirees to stretch their savings and enjoy a comfortable lifestyle.

13 Indiana

One of the most attractive aspects of retiring in Indiana is its cost of living, which is notably lower than the national average. Housing costs are significantly more affordable, with median home prices well below the national median. Additionally, everyday expenses such as groceries, utilities, and transportation are also more budget-friendly. Indiana's low cost of living allows retirees to stretch their savings further, making it an ideal destination for those looking to maximize their retirement funds. The state's favorable tax policies, including no state tax on Social Security benefits, further enhance its affordability for retirees.

14 Louisiana

The cost of living in Louisiana is generally lower than the national average. Housing costs, in particular, are significantly more affordable, making it an attractive destination for retirees on a fixed income. Additionally, Louisiana offers tax benefits for retirees, including exemptions on Social Security benefits and partial exemptions on retirement income.

Louisiana's cost of living is approximately 7% lower than the national average, making it a more affordable option for retirees compared to many other states.

15 Michigan

The cost of living in Michigan is relatively affordable compared to the national average. Housing costs, in particular, are significantly lower, with median home prices well below the national median. Groceries, utilities, and transportation costs are also generally below the national average. However, healthcare costs can vary, with some regions being more expensive than others. Overall, Michigan provides a comfortable and affordable lifestyle for retirees.

16 Wyoming

The cost of living in Wyoming is generally lower than the national average. The state's lack of state income tax is a significant financial benefit for retirees, as it can lead to considerable savings. Property taxes are also relatively low, making homeownership more affordable.

However, the cost of goods and services can be higher in some areas due to the state's remote location and smaller market size. Housing costs, in particular, can vary significantly depending on the region, with areas near popular tourist destinations being more expensive. On the whole, Wyoming offers a cost-effective retirement option compared to many other states, especially for those who own their homes and live on a fixed income.

17 Texas

One of the most significant advantages of retiring in Texas is the relatively low cost of living. Housing costs, a major component of the cost of living, are generally lower than the national average, making it more affordable to purchase a home or rent an apartment. The absence of a state income tax is another financial benefit, allowing retirees to stretch their savings further.

While property taxes in Texas can be higher than in some other states, the overall tax burden remains moderate. Utilities, groceries, and healthcare costs are also generally in line with or slightly below the national average, contributing to a comfortable and affordable lifestyle.

18 Kentucky

One of the most attractive aspects of retiring in Kentucky is the affordable cost of living. Housing, groceries, utilities, and transportation are generally lower than the national average. Kentucky also offers tax advantages for retirees, including exemptions on Social Security benefits and low property taxes, making it a budget-friendly option for those on a fixed income.

Kentucky's cost of living is significantly lower than the national average, particularly in housing and healthcare. This affordability allows retirees to stretch their retirement savings further and enjoy a comfortable lifestyle without financial strain.

19 South Dakota

One of South Dakota's most attractive features for retirees is its low cost of living. The state consistently ranks below the national average in terms of housing costs, utilities, and overall living expenses. According to recent data, housing costs in South Dakota are significantly lower than the national average, making it easier for retirees to find affordable homes or rental properties. Additionally, South Dakota does not have a state income tax, which can be a considerable financial benefit for those on a fixed retirement income. Overall, retirees can stretch their dollars further in South Dakota compared to many other states.

20 Ohio

One of Ohio's most attractive features for retirees is its affordability. The cost of living in Ohio is significantly lower than the national average. Housing, in particular, is more affordable, with median home prices well below the national median. Additionally, Ohio's property taxes are relatively moderate, and the state does not tax Social Security benefits, providing further financial relief for retirees.

Comparison to National Average: The cost of living in Ohio is approximately 10% lower than the national average. This affordability extends to healthcare, groceries, and transportation, making it an excellent choice for retirees looking to stretch their retirement savings.

21 Minnesota

Minnesota's cost of living is slightly above the national average, particularly in urban areas like the Twin Cities. Housing costs vary significantly across the state, with metropolitan areas being more expensive than rural regions. However, Minnesota offers affordable options for retirees, especially in smaller towns and suburban areas.

While some essentials like healthcare and groceries may cost more than the national average, Minnesota has a relatively low state income tax rate for retirees. Additionally, the state offers several property tax relief programs for seniors, which can help offset living expenses.

22 New Mexico

New Mexico: The cost of living in New Mexico is generally lower than the national average. Housing, in particular, is more affordable, with median home prices significantly below the national median. Utilities and groceries also tend to be cheaper. However, the state does have a higher tax burden, including taxes on Social Security income.

National Average: Compared to the national average, retirees in New Mexico can expect to spend less on housing and daily expenses. This affordability makes it an attractive option for those looking to stretch their retirement savings.

23 North Dakota

North Dakota has a relatively low cost of living compared to the national average. Housing costs, in particular, are significantly lower, making it an affordable option for retirees. Groceries, utilities, and healthcare costs are also generally below the national average, although they may vary depending on the specific region within the state.

Comparison to National Average: Overall, retirees can expect to stretch their retirement savings further in North Dakota, with a lower cost of living across most categories. However, it's important to note that rural areas may have fewer services and amenities, which could impact the overall convenience and availability of certain goods and services.

24 Wisconsin

One of the most attractive aspects of retiring in Wisconsin is its moderate cost of living. Housing costs are generally lower than the national average, making it easier for retirees to find affordable homes. Additionally, groceries, transportation, and healthcare expenses are also below the national average.

Comparison to National Average: The cost of living in Wisconsin is approximately 5-10% lower than the national average. This affordability extends to both urban and rural areas, making it an appealing option for retirees looking to stretch their retirement savings.

North Carolina boasts a cost of living below the national average, making it an attractive option for retirees. Housing is particularly affordable, with the median home price significantly lower than the national median. Utilities, groceries, and transportation costs are also below average, allowing retirees to stretch their savings further.

Taxes are another important consideration for retirees. North Carolina has a moderate tax environment, with a flat state income tax rate of 5.25%. Social Security benefits are not taxed, but other retirement income may be subject to state income tax. Property taxes are relatively low, and there is a homestead exemption available for seniors, which can reduce property tax bills.

South Carolina is known for its affordable cost of living, which is generally below the national average. Housing costs, in particular, are quite reasonable, with median home prices significantly lower than in many other states. This affordability extends to other expenses, including groceries, utilities, and transportation. Retirees can often find comfortable living arrangements without stretching their budgets, making the state an attractive option for those on fixed incomes.

National Average Comparison: The cost of living in South Carolina is consistently lower than the national average, particularly in housing. This affordability makes it a popular choice for retirees looking to maximize their retirement savings.

27 Pennsylvania

Pennsylvania's cost of living is relatively moderate compared to the national average. Housing costs are generally lower than the national average, making it an attractive option for retirees on a fixed income. The median home price in Pennsylvania is often below the national median, and property taxes, while slightly above average, are still manageable. Additionally, Pennsylvania does not tax retirement income, which is a significant advantage for retirees.

Groceries, utilities, and healthcare costs in Pennsylvania are close to the national average, with some regional variations. The overall affordability of the state makes it a viable option for retirees looking to stretch their retirement savings.

28 Nevada

The cost of living in Nevada is relatively moderate. While some areas, like Las Vegas and Reno, can be more expensive, especially in terms of housing, other regions offer more affordable options. The absence of a state income tax is a significant financial advantage, allowing retirees to stretch their savings further. However, the sales tax and property taxes are relatively high compared to the national average, which can offset some of these savings.

Overall, Nevada's cost of living is close to the national average, with housing costs slightly above average in urban areas but more affordable in rural parts.

29 Utah

Utah's cost of living is relatively moderate compared to the national average. While housing costs can vary significantly depending on the location, the state's overall affordability is attractive to retirees. Housing prices in Utah have been on the rise, particularly in popular areas like Salt Lake City, but more rural or suburban areas offer more affordable options. Utility costs and taxes are also generally lower than in many other states.

Utah does have a state income tax, but it also offers various exemptions and credits for seniors, making it a relatively tax-friendly state for retirees. The state's overall cost of living index is close to the national average, making it an affordable choice for many.

30 Florida

The cost of living in Florida varies widely depending on the region. While some areas, like Miami and Fort Lauderdale, have higher living costs, many parts of the state offer a more affordable lifestyle. Florida has no state income tax, which can be a significant financial advantage for retirees living on fixed incomes. Housing costs, a significant component of living expenses, are generally in line with the national average but can be higher in coastal and metropolitan areas.

Comparison to National Average: Florida's cost of living is relatively close to the national average, with some areas being more affordable and others more expensive. The absence of a state income tax is a notable financial benefit compared to many other states.

31 Delaware

The cost of living in Delaware is generally close to the national average, with some variances depending on location. Housing costs can be higher in coastal areas and popular towns like Rehoboth Beach and Wilmington. However, compared to neighboring states like New Jersey and Maryland, Delaware offers more affordable real estate options.

One significant financial benefit for retirees is the absence of a state sales tax, which can help reduce the overall cost of goods and services. Additionally, Delaware offers tax-friendly policies for retirees, including exemptions on Social Security benefits and lower taxes on pension income.

32 Virginia

The cost of living in Virginia can vary significantly depending on the region. Generally, urban areas like Northern Virginia, especially around Washington, D.C., tend to have a higher cost of living compared to rural areas in the western and southern parts of the state. Housing costs, in particular, can be a significant factor in the overall cost of living. However, compared to other East Coast states like New York and Maryland, Virginia is relatively more affordable.

On average, the cost of living in Virginia is slightly above the national average. Housing, transportation, and healthcare are the primary drivers of this difference. However, retirees can find more affordable options in smaller towns and rural areas, where the cost of living is closer to the national average.

33 Montana

Montana's cost of living is slightly higher than the national average, primarily due to housing costs. While the state offers affordable options in some rural areas, popular destinations like Bozeman and Missoula can be more expensive. The median home price in Montana is higher than the national median, reflecting the demand for housing in scenic locations.

Other expenses, such as groceries, utilities, and healthcare, are generally on par with or slightly above the national average. However, Montana does not have a state sales tax, which can offset some of the higher costs. Retirees can find a range of living options, from small towns to more developed cities, each offering different price points.

34 Colorado

The cost of living in Colorado is slightly above the national average. Housing, in particular, can be more expensive, especially in popular areas like Denver, Boulder, and Fort Collins. However, there are more affordable options in smaller towns and rural areas. The state has a relatively low property tax rate, which can be beneficial for retirees on a fixed income. While groceries, healthcare, and transportation costs are close to the national average, the overall cost of living can be higher due to housing costs.

35 Idaho

Cost of living in Idaho is generally lower than the national average. Housing costs, in particular, are more affordable, with median home prices significantly below those in many other states. Retirees can find a range of housing options, from single-family homes to retirement communities.

Other expenses, such as groceries, utilities, and healthcare, are also relatively low. The state's tax policies are friendly to retirees, with no taxes on Social Security benefits and relatively low property taxes. Overall, Idaho offers a cost-effective lifestyle that allows retirees to stretch their retirement savings further.

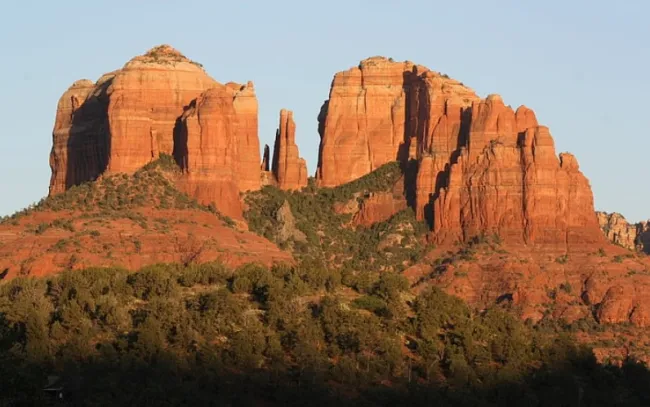

36 Arizona

Arizona's cost of living is slightly below the national average, making it an affordable option for retirees. Housing costs, in particular, are generally lower than in many other states, especially compared to coastal regions. This affordability extends to utilities, groceries, and transportation, which tend to be reasonably priced.

While the overall cost of living is favorable, it's important to note that some areas in Arizona, such as Scottsdale and Sedona, can be more expensive. However, retirees can find more budget-friendly options in cities like Tucson or smaller towns throughout the state.

37 Rhode Island

Rhode Island's cost of living is above the national average. Housing, in particular, tends to be more expensive, with median home prices higher than the national median. However, the state does not tax Social Security benefits, which can be a financial advantage for retirees. Property taxes and overall tax burdens are relatively high, which may impact budgeting.

While more affordable than neighboring states like Massachusetts and Connecticut, Rhode Island's overall cost of living is still above the national average. Retirees should consider this when planning their finances.

38 Maine

The cost of living in Maine is slightly higher than the national average, primarily due to housing costs. While housing prices in coastal areas can be relatively high, there are more affordable options in inland regions. Overall, healthcare and utilities are comparable to the national average, while groceries and transportation costs are slightly lower.

For retirees, Maine offers a variety of housing options, including cozy cottages, modern condos, and historic homes. The state's property tax rates are moderate, and there are exemptions and deductions available for seniors, which can help alleviate the financial burden.

39 Connecticut

The cost of living in Connecticut is notably higher than the national average. Housing, in particular, is a significant expense, with property values and rental rates surpassing those of many other states. While this can be a drawback, it often correlates with the state's desirable amenities and quality of life.

Utilities, groceries, and transportation costs are also above the national average. However, retirees may find relief in the absence of taxes on Social Security benefits and the relatively low property taxes for senior citizens, depending on income and other factors.

40 New Jersey

The cost of living in New Jersey is notably higher than the national average. Housing costs, in particular, can be substantial, especially in desirable coastal and suburban areas. Property taxes are among the highest in the country, which can be a significant consideration for retirees on a fixed income. However, the state offers property tax relief programs for seniors, which can help alleviate some of the financial burdens.

While the cost of healthcare, groceries, and utilities is also above the national average, the state's higher median income often offsets these expenses. Retirees may find that their purchasing power varies significantly depending on the region within the state, with the northern and coastal areas being more expensive than the south.

41 Vermont

Vermont's cost of living is slightly higher than the national average, particularly in housing and groceries. While the state does not have a sales tax on clothing and footwear, it does have a relatively high property tax rate. However, the overall tax burden is moderate, with no state taxes on Social Security benefits, making it a tax-friendly state for retirees.

Housing costs vary depending on the location, with Burlington and its surrounding areas being more expensive. In rural areas, housing tends to be more affordable, offering retirees a range of options from quaint farmhouses to cozy cabins. Utilities and healthcare costs are generally in line with the national average, though the colder climate may result in higher heating expenses during winter months.

While New Hampshire offers a high quality of life, it comes with a cost. The state's cost of living is slightly above the national average, driven mainly by housing and healthcare expenses. However, this is balanced by the absence of state income tax and sales tax, which can significantly reduce the overall financial burden for retirees.

Housing costs can be high, particularly in desirable areas like the Lakes Region or along the Seacoast. However, more affordable options are available in the state's interior or northern regions. Compared to other states in the Northeast, New Hampshire offers a relatively moderate cost of living, making it a viable option for those looking to retire in this region.

43 Oregon

The cost of living in Oregon is slightly above the national average. Housing costs, in particular, can be higher, especially in popular cities like Portland, Bend, and Eugene. However, the state does not have a sales tax, which can help offset some expenses. Utilities and healthcare costs are also relatively high compared to the national average.

Retirees should consider these factors when planning their budgets. While Oregon offers many amenities, the cost of enjoying them can be higher than in other states, particularly in urban areas. Rural and suburban regions may offer more affordable living options without sacrificing quality of life.

44 Washington

The cost of living in Washington State is notably higher than the national average, especially in urban areas like Seattle, Bellevue, and Redmond. Housing costs are a significant factor, with real estate prices considerably above the national median. However, Washington's lack of state income tax can offset some of the higher living costs, making it a more tax-friendly state for retirees with fixed incomes.

While groceries, utilities, and transportation costs are also higher than the national average, many retirees find value in the state's amenities, such as its well-maintained parks and public facilities. Additionally, rural areas and smaller cities offer more affordable living options compared to the state's major urban centers.

45 Maryland

The cost of living in Maryland is relatively high, particularly in urban areas and close to major cities like Washington, D.C. Housing costs, in particular, are above the national average, especially in sought-after areas like Montgomery County. However, the state's high median income helps offset these costs.

Comparison to National Average: Maryland's cost of living is above the national average, largely due to higher housing and healthcare costs. However, the state does not tax Social Security benefits, which can be a significant advantage for retirees.

46 Alaska

The cost of living in Alaska is generally higher than the national average. This is largely due to the state's remote location, which drives up the prices of goods and services. Groceries, utilities, and transportation costs can be significantly higher than in other states. However, Alaska does not have a state sales tax or personal income tax, which can offset some of these expenses for retirees.

Housing costs vary widely depending on the region. Urban areas like Anchorage and Fairbanks may have higher housing costs compared to more rural areas. Additionally, retirees may benefit from the Alaska Permanent Fund Dividend, an annual payment to residents that can provide supplemental income.

47 New York

The cost of living in New York State varies significantly depending on the region. New York City and its surrounding suburbs are among the most expensive areas in the country, with high housing costs and living expenses. However, upstate New York offers a more affordable alternative, with lower housing prices, property taxes, and everyday living costs.

Retirees should consider their lifestyle preferences and financial situation when choosing where to live. While urban areas may offer more amenities and activities, the rural and suburban regions of the state provide a lower cost of living, which can be appealing for those on a fixed income.

48 California

California is known for its high cost of living, which is significantly above the national average. Housing costs, in particular, are a major expense, with property values and rental prices often much higher than in other states. Utilities, groceries, and transportation also tend to be more expensive.

While the state offers various amenities and a high standard of living, retirees on a fixed income may find their budget stretched. However, certain areas in California, particularly away from major cities, offer more affordable living options.

The cost of living in Massachusetts is significantly higher than the national average. Housing costs, in particular, are a major factor, with median home prices well above the national median. Additionally, utilities, groceries, and healthcare costs tend to be higher. While the state offers a high standard of living, retirees on a fixed income may need to budget carefully or consider less expensive areas within the state, such as the western regions, which tend to be more affordable than the Boston metropolitan area.

The cost of living in Massachusetts is considerably higher, especially in housing and healthcare, making it one of the more expensive states to retire in.

50 Hawaii

One of the most critical factors to consider when retiring in Hawaii is the cost of living, which is notably higher than the national average. The state has some of the highest housing costs in the country, with median home prices well above the national median. Additionally, the cost of groceries, utilities, and other essential goods is elevated due to the state's remote location and reliance on imports.

Retirees should carefully evaluate their financial situation and budget when considering a move to Hawaii. While the state's natural beauty and lifestyle are appealing, the financial aspect can be challenging for those on a fixed income.